The digital buyers of Southeast Asia develop new characteristics after the pandemic by shifting from online to offline. Despite the uncertainties, the economy is still predicted to have a positive curve in the future. Based on some reports, this article will summarize the top 7 key insights of 2023’s online consumers in the home of eleven countries among India & China.

Are you planning to enter Southeast Asian digital markets?

I know what you’re targeting: the 680+ million people, right?

The promising value of its digital economy is expected to hit 222 billion this year.

Yup, Southeast Asia is fertile ground to grow a business.

Investors & companies have been eyeing this potential market in recent years to expand their businesses.

Even the great pandemic yesterday doesn’t blow a single strand of Southeast Asia’s strong economy.

But some uncertainties still impact its consumer behavior somehow.

How it affects the digital consumer landscape in Southeast Asia?

What are the trends now, and how will they shape the future’s prospects?

Here are the most important insights into the digital consumer behavior of Southeast Asia in 2023.

Let’s dive in.

TL;DR: The Top 7 key insights of online shoppers in Southeast Asia in 2023:

- Southeast Asia’s economy is still optimistic amid global uncertainty

- Southeast Asia’s digital consumer population growing steadily

- Consumers in Southeast Asia seek an integrated shopping experience after the pandemic

- Social videos are the ultimate online discovery for Southeast Asian shoppers

- Southeast Asian Digital Consumers are experimental & seek more value

- Customer satisfaction in Southeast Asia drops

- The Growing consumer trends in Indochina: Social Video, Business Messaging, & Creator Economy

What is the state of Southeast Asia’s digital consumers in 2023?

Positive.

That is the perfect word to describe the future of Southeast Asia’s economy.

It is still promising despite obstacles & uncertainties during the Covid-19 pandemic.

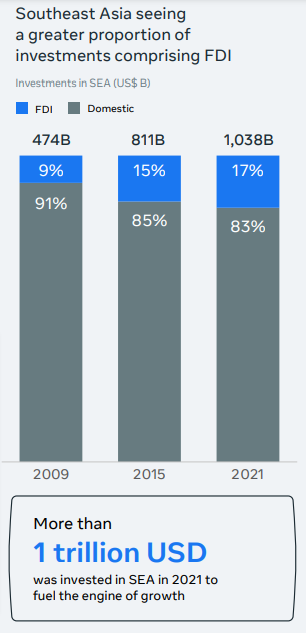

In 2021, SEA received over 1 billion foreign investments in their economy.

The digital transformation in Indochina also affects the economy, how shoppers look for products,

And basically all the future prospects in that region.

Let’s dive deeper into the trends and see how they can help grow your business.

1. Southeast Asia’s economy is still optimistic amid global uncertainty

The worlds are in an alert state of upcoming inflations & financial challenges.

But not for Southeast Asia.

Surprisingly, it is relatively less impacted compared to other regions.

Two strongest factors: are high GDP growth and the rise of the working population.

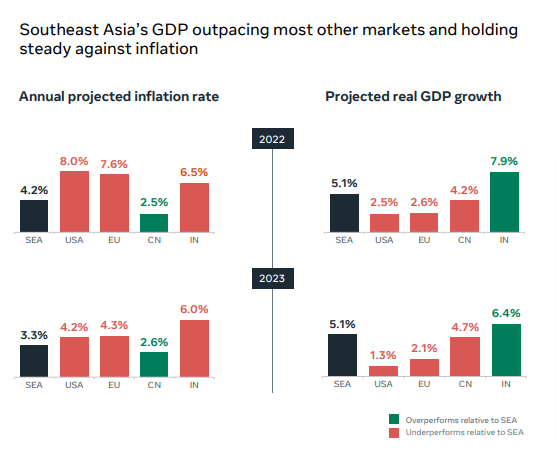

First, the projected GDP growth and annual inflation rate from 2023 to 2023 in SEA

Are predicted to perform better than other big markets like the US and the EU.

The region’s working population is also set to grow rapidly by 23 million people by 2030.

Indonesia leads the number with 13 million people increase,

The Philippines with 9 million, and Malaysia & Vietnam with 2 million people.

Another worth mentioning factor is how the upper-middle-class & high-class citizens are gradually going up.

Both 22 million people & 29 million people respectively.

2. Southeast Asia’s digital consumer population growing steadily

Talking about digital consumers won’t be complete if we don’t discuss the number of people.

The positive state is actually supported by a steady growth of online shoppers in Southeast Asia.

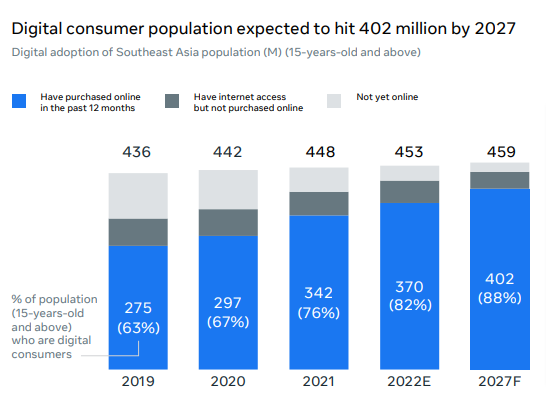

By 2027, the population is projected to hit 402 million users.

The number also shows a significant portion of digital customers compared to the whole population, which takes up to 88%.

When there are more people buying, it means more consumption to count.

3. Consumers in Southeast Asia seek an integrated shopping experience in offline & online channels after the pandemic

Don’t get me wrong, the “pandemic switch” affects a lot of SEA’s online consumer behavior.

The grandest insight: they want an integrated channel for future shopping.

The pandemic has forced Southeast Asian online buyers to shop online.

As the condition gets better, online activity is dropping,

Followed by a great number of consumers moving to the offline option.

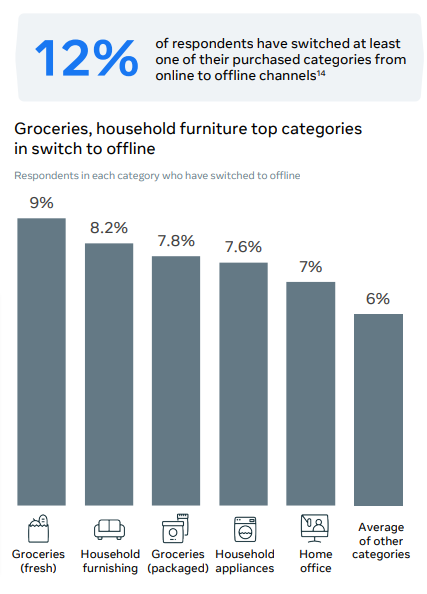

A study says, at least 12% of their respondents have moved to offline channels to shop.

As you can see above, Groceries are in the top category of online-to-offline-switching, followed by household furnishing.

“But, why do people come back to offline shopping?”

Experiencing the goods on their own is the ultimate reason for this switching.

Another reason is they don’t want to pay shipping fees anymore.

Some might see a markup price on the shipping, but it might also be affected by the logistics spend.

But that doesn’t mean there is no one prefers online shopping.

eCommerce & online channels will be still in the consumer journey, but offline is still crucial at the purchase stage.

While in the discovery stage of digital shoppers, social videos are important.

Let’s go further in the next discussion.

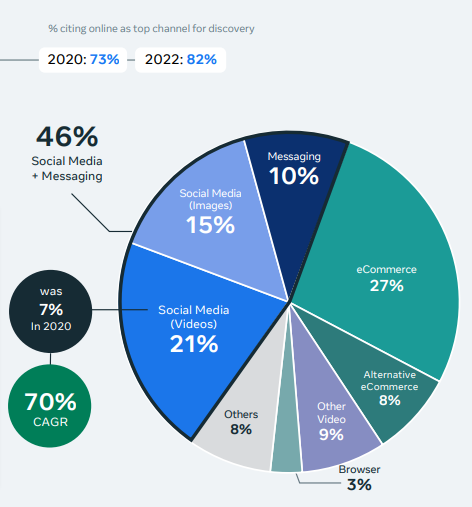

4. Social media videos are the fastest-growing channel for online discovery for Southeast Asian shoppers

If your brand wants to penetrate SEA’s digital market,

Boosting social videos must be the best tactic to win them.

Social media has taken the biggest influence on the purchasing journey of SEA, especially for videos.

The growth of social videos is fascinating, from 7% in 2020 to 21% in 2023

Generating a 70% of compounded annual growth rate (CAGR).

In the overall purchasing stages of SEA’s digital buyers,

Social media has an essential role in discovery & examination.

So, pushing brand & product awareness, giving more infos about the product,

And working with influencers to give reviews on social media is the best strategy to win the SEA online consumers.

Take advantage of the moment of the rise of the digital economy in Indochina!

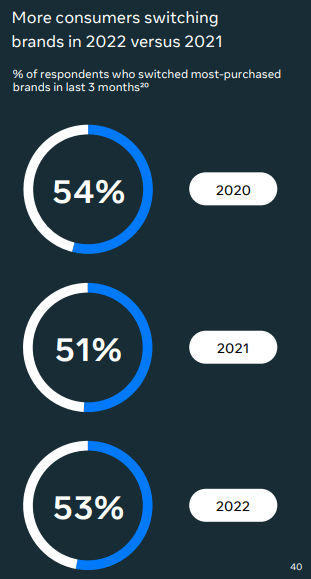

5. Southeast Asian Online Customers are experimental & seek more value

Digital consumers in SEA don’t like to stick to only one brand.

In certain categories like clothing, footwear, & beauty, people are more experimental by switching brands.

This behavior comes from 54% of the total digital customers, grows 3% compared to last year, but is decreasing by 1% compared to 2020.

Look at the stats.

The reason varies depending on each SEA country.

But the top cause is always seeking better value & better products.

The last reason is that they are bored with the previous brand, or just a simple product availability.

The same pattern of switching also happens to shop platforms.

The top 3 reasons for Southeast Asian digital buyers:

They are looking for better prices, product quality, & delivery pricing.

It is also a chance to look for more diverse options & good value deals for their needs.

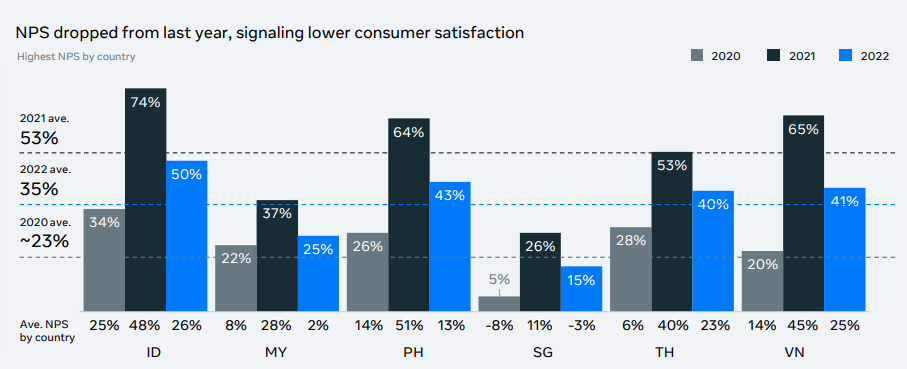

6. Customer satisfaction in Southeast Asia for online shopping drops

From the previous insights, we can see a positive trend.

However, SEA customers might seem a little unsatisfied with the current online experience.

It can be caused by the online-to-offline-switching phase, or simply,

SEA customers demand more from the online experience, like more integration on both channels.

This is data explaining a decline in customer satisfaction using the company measurement.

NPS is Net Promoter Score, a rating from customers from 1 to 10 about how likely they recommend the service to their close ones.

And these are the results from some countries in Southeast Asia.

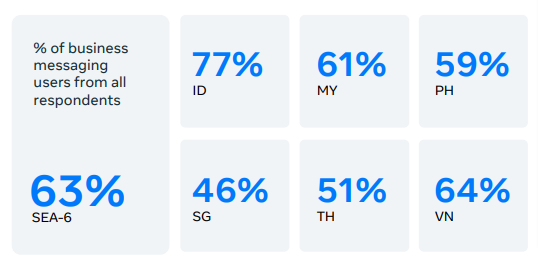

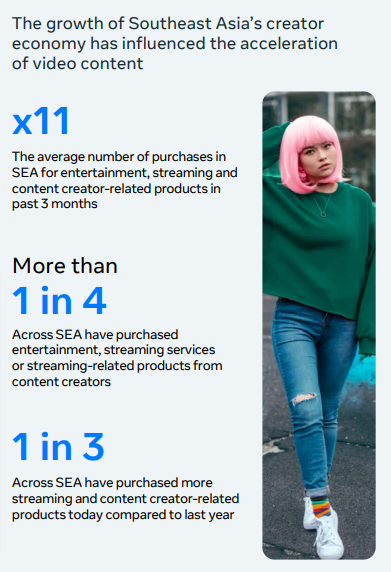

7. The Growing consumer trends in Indochina: Social Video, Business Messaging, & Creator Economy

Three important trends to watch for entering the SEA’s digital market:

Social videos, business messaging, & creator economy.

Southeast Asian digital customers use videos often to find & compare products.

The next stage is examining them. Customers can go through reviews, and the brand’s official social accounts,

Or even straight to messaging the business and asking relevant questions.

Users are more convenient that way, and it is considered more communicative.

This leads to a rise in business messaging which has been used by an average of 63% of respondents in SEA in 2021.

The users’ search for a deep understanding of the brand or product indicates

The need for more engagement from the brand.

Leveraging SEA content creators is one way to gain more engagement PLUS drive sales.

They are the best video content producer & their genuine relationship with their audience is the perfect way to increase engagement.

Look at these drooling stats.

Now, based on the growing trends, the best strategy to conquer the market is:

Work with Southeast Asian influencers to generate the best-quality video content.

And maintain customer service through business messaging.

This is very much in line with the state of the influencer marketing industry in Southeast Asia.

Focusing on influencer campaigns might bring your brand to quick growth in Indochina.

Our Advice: Take advantage of the most important key insights of Southeast Asian online consumers in 2023 for your business

More & more investors are eyeing the potential of Southeast Asia for its strong economic growth.

If you are a brand trying to make it in Indochina land,

It’s crucial to understand the most important insights into SEA digital consumer behavior.

And I have done my job, listing the thing you must pay attention to.

Now, it’s your turn to make the insights not just end up on this blog,

But turn them into tangible results for your business.

My best advice: collaborate with Southeast Asian influencers

While still managing business messaging through WhatsApp, Instagram DM, and more.

Influencer’s content is like an album of brand reviews which are later used by SEA digital buyers to compare products and brands.

They can help your brand produce video content which now impacts consumers’ product discovery.

Creators are also very helpful to generate more engagement.

Choose specifically from each country like Malaysia, The Philippines, Indonesia, Vietnam, and more.

Or you want to be unique by working with the virtual ones.

Anyone will work just fine as long as you choose the one that resonates best with your brand image.

Do you have another brilliant strategy from these trends? What is it?

Let’s discuss this in the comments below 👇🏼

Note: Contribute your thoughts & contact us here if you think we miss something to talk about.

More Questions about South East Asian Digital Marketing Consumers?

What is the expectation of digital buyers in Southeast Asia towards brands?

From users’ point of view, these are what they want brands to give: have more value & better prices, bring more information about their products, be available in business messaging, and have an integrated online-to-offline purchase process.

How to make the best strategy using the SEA digital consumer behavior insights?

Take the most important trends that can help your business grow & sustain in Indochina. For me, focusing on what SEA online customers need and want is very important. This means, paying attention to social videos, increasing engagement, giving more value, and providing easier online-to-offline shopping experiences to customers is the fuel to make the best strategy to enter the prolific market.

Article By

Gregory Taslaud

Founder and Full time Blogger at INSG. Inbound Marketing enthusiast since 2001, I love data, test and review Tools. On a mission to build Media & eCommerce projects with various Brands and Creators.